Table of Contents

TSLA StockTwits: Tesla’s stock had another challenging day following its earnings report, a familiar scenario for seasoned investors. However, there’s optimism that the situation could improve in the near future.

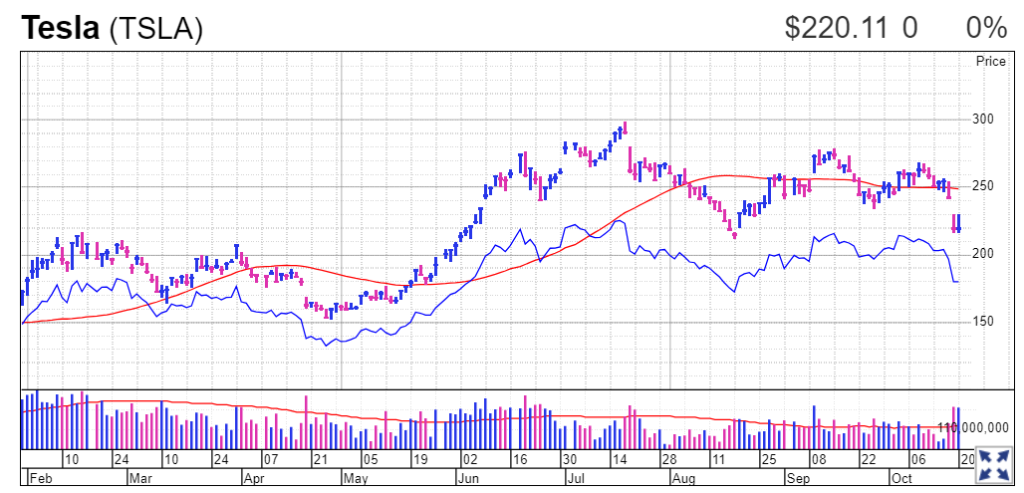

For the third consecutive time, Tesla’s stock (TSLA) took a hit after the electric-vehicle giant released its quarterly results. This time, shares plummeted by 9.7% following the disappointing first-quarter earnings for 2023. It’s worth noting that the same percentage decline occurred after the second-quarter report. The trend continued as Tesla reported a disappointing 9.3% drop, with shares closing at $220.11, following the release of underwhelming third-quarter results. The stock was down an additional 0.8% in premarket trading on Friday.

These drops in Tesla’s stock were primarily attributed to concerns about profit margins and pricing. Price reductions pushed operating profit margins below 8%, marking a substantial decrease of nearly 10 percentage points year over year. Adding to the pessimism, Tesla’s CEO, Elon Musk, expressed concerns about high interest rates impacting demand and the uncertain economic environment during the company’s conference call.

While the recent history suggests that Tesla may experience a slight recovery in the short term, the road ahead remains uncertain. On average, shares tend to gain 0.4% the day after an earnings dip, and they have rebounded seven times. A week following the initial decline, shares have typically risen by an average of 1.4%, indicating a slight improvement from the initial drop.

Market technician Frank Cappelleri, founder of CappThesis, identifies key levels for investors to monitor. Tesla stock, which began the year at approximately $123 per share and once traded above $290, has now retraced to $222, marking a 38% decline – a level closely observed by technical traders for potential buying opportunities. Additionally, the $217 level, mirroring the highs in February and June, and the $214 level, representing the 200-day moving average, are crucial points to watch. Falling below $214 would signal further challenges for investors.

Tesla investors are no strangers to volatility during earnings season. On average, Tesla stock experiences a 7% move, either up or down, after an earnings report. In contrast, the average move for Apple (AAPL) shares following their earnings reports is around 4%.

One unique aspect of Tesla is its post-earnings performance, with the stock dropping approximately 58% of the time after earnings, compared to Apple shares, which rise about 58% of the time following their earnings reports. Furthermore, Tesla has missed earnings estimates 13 times in the past 41 quarters, whereas Apple has only missed earnings three times.

In the world of stocks, Tesla remains a unique and dynamic entity, continually presenting investors with both opportunities and challenges.

Understanding TSLA Stock

Before we dive into the realm of StockTwits, let’s start by understanding TSLA stock. Tesla, Inc. (TSLA) is an American electric vehicle and clean energy company founded by Elon Musk. The company has revolutionized the automotive and energy industries and has garnered the attention of investors worldwide.

Why TSLA Stock?

Investing in Tesla offers exciting opportunities for growth. As the electric vehicle market expands, Tesla remains at the forefront of innovation and profitability. From electric cars and energy storage to solar technology, Tesla’s diversification continues to impress investors.

Enter StockTwits: Your Investment Ally

StockTwits is a social media platform designed for investors and traders. It’s where financial enthusiasts share their insights, analyses, and predictions about stocks. Here’s how it can help you maximize your Tesla investments:

- Real-Time Updates: StockTwits provides real-time updates on TSLA stock, ensuring you’re never out of the loop regarding price changes and market sentiment.

- Community Knowledge: Join discussions and tap into the collective wisdom of experienced investors. Learn from their successes and mistakes.

- Expert Insights: Follow prominent investors and analysts who share their insights, strategies, and predictions on Tesla. Gain a deeper understanding of the market.

- Chart Analysis: Explore technical analysis charts shared by users, helping you make more informed decisions on when to buy, sell, or hold your TSLA stocks.

- Sentiment Analysis: Understand market sentiment through StockTwits’ sentiment analysis tools. Discover how other investors feel about TSLA and use that insight to your advantage.

Maximizing Your Investments

Here are some strategies for optimizing your Tesla investments using TSLA StockTwits:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Use insights from StockTwits to diversify your investment portfolio.

- Long-Term Vision: Consider a long-term investment strategy for TSLA stock, in line with Tesla’s growth potential.

- Risk Management: Implement risk management strategies based on the information shared by StockTwits users.

- Continuous Learning: Stay updated with the latest news and analyses on Tesla. StockTwits is an excellent source of up-to-date information.

- Discipline and Patience: Be patient and disciplined in your investment approach. Use StockTwits to confirm your decisions, but avoid impulsive actions.